MLCC out of the price bottom, the industry growth will have a new logic (2023/5/26 11:23:06)

Speaking of MLCC (multi-layer ceramic capacitors), its "highlight moment" dates back to the price rise that began in 2017. In the recent wave of "core shortage tide", MLCC is outside the cycle, not much performance. In 2021, MLCC was the first to feel the chill in declining demand and began a 14-month price reduction cycle. Until the second quarter of this year, the industry chain to inventory into the final stage, combined with the MLCC manufacturers control shipments (according to set state consulting TrendForce, 1-April MLCC suppliers total shipments 1.359 billion, down 34%), the market situation, at the same time, the industry chain to inventory is basically completed, emerged some new goods demand.

According to the market information reported by major media, the price of different specifications and models of MLCC increased more or less in the first quarter, and the increase of high-capacity products increased by 20% -40%, and that of low-capacity products increased by 10% -20%. Some enterprise executives said that new energy vehicles, photovoltaic inverters and servers and other fields, MLCC demand is obvious. With the new field demand as a guarantee, MLCC manufacturers are optimistic about the future shipments, and the price increase is naturally in the plan.

At the end of the first quarter, Sanhuan Group, one of the leading MLCC in China, released price increase information, announcing that the actual transaction price of each set of orders in the second quarter was increased, and all contracted customers were adjusted and implemented in the same proportion when the approval of new set of orders submitted in April. When asked about the next plan in investor activities, Dachang Fenghua High-tech said it would "follow the market", some of the price increase. In addition to domestic manufacturers, there is also news that the Japanese village will rise 10%.

Recently, the price increase news frequency appears, it can be confirmed that this round of MLCC price decline market has bottomed out. But from the first quarter of mobile phones, PC and other bulk consumer goods shipments, new demand will take time to emerge. Now the MLCC market price change is not so much a price increase as a "price return". MLCC manufacturers need to follow a new industrial logic if they want to seek performance growth in such a market environment.

Demand is changing, and the industry is running on a new logic

Like the IC market, the demand expectation of MLCC is also affected by two factors. On the one hand, the decline in shipments caused by the sluggish demand for consumer goods, on the other hand, the demand growth brought by the increase in the consumption of single equipment and single vehicle. In the future, the demand change of MLCC depends on the strength pattern of these two factors. So, which area of demand is expected to pull back the overall market decline? The answer is high-end markets such as automobiles, which is why in recent years leading manufacturers have been strengthening high specifications and automotive materials.

One of the root causes of MLCC prices, which began in 2017, is that TDK and other Japanese factories withdrew from the general market and turned to the development of automotive and industrial fields, resulting in a huge market gap. From the current situation, the most dynamic in all fields, basically only high-specification markets such as automobiles. Moreover, with the continuous deepening of the new energy and intelligence of vehicles, vehicle MLCC has a broad space for development.

According to the data of Japanese MLCC Murata, in 2021, the consumption of a high-end smart phone has exceeded 1,000, while the consumption of a single traditional fuel car is 3,000-5,000. Murata forecast, the future car using MLCC in the type and quantity will further increase, a hybrid MLCC demand in around 12000, and pure electric vehicles can reach about 18000, such as a L2 + automatic driving electric car, MLCC use quantity reached more than 10000, part of the high-end models of MLCC dosage even 30000.

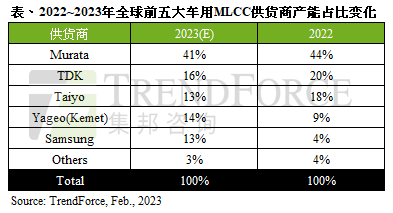

From murata's statistics and forecasts, it can be seen that the potential of the emerging car market far exceeds that of mobile phones. The gap is both in quantity and in price. The average unit price of car MLCC is 2-3 times higher than that of mobile phone materials, which is undoubtedly a high value-added product. At the same time, according to the TrendForce survey, the order volume of vehicle MLCC in the first quarter of 2023 is relatively stable, and the expansion pace of production of major manufacturers has not slowed down. From the second quarter of this year, it is expected that the monthly production capacity of MLCC will reach 25 billion, stabilizing the market leader. After the expansion of TDK in Iwate Prefecture, the monthly capacity will increase by 5 billion to 8 billion units. Samsung, Sun Power in 2023, the vehicle production capacity increased significantly in 2023, with the average monthly production capacity increased by 2 billion to 3 billion.

In the first quarter, it was also noteworthy that Murata closed two subsidiaries due to sluggish mobile phone demand and revised this year's mobile phone shipment forecast from 1.09 billion units to 1.07 billion units. Murata's opposite operations in the automotive and mobile sectors show the opportunities for the MLCC industry. To this general trend, Dachang outside Japan are also insightful, among which the national giants in Taiwan have the deepest focus on the diversified layout.

In May last year, Guoju followed the footsteps of Japanese manufacturers and targeted the expansion of high-specification MLCC. The specific project was settled in Kaohsiung City, which is expected to be mass-produced in the second half of this year. By the end of this year, Guoju's high-order MLCC production capacity could be expanded by 15 to 20 percent, mainly for vehicles.

Before 2017,70% of its revenue came from standards, and the remaining 30% came from the high-end market in Europe, America and Japan; now, China has acquired passive component factories such as Psi and Kimei, and the sensor departments of Heraeus and Schneider, which has not only increased the capacity and market share, but also significantly improved the revenue structure. In the first quarter of this year, the revenue of China giant industrial products accounted for 31%, car accounted for 23%, communication accounted for 14%, the field of high gross margin revenue increased significantly, especially in the aspect of car products, breaking the previous situation of Japanese dominance.

China Giant's share of automotive MLCC is expected to surpass solar power induction by 14% this year

Statistical source: TrendForce

From the trend of Japanese factories and giants, in the context of the declining consumer electronics market, the best way to ensure sustained profit growth is to move to higher-end fields such as automobiles, and try to offset the uncertainty of the environment through the product portfolio with high gross margin. To this point, Chen Taiming, chairman of Guoju, pointed out as early as last year that the standard of the main company, the next 1-2 years may be very hard. This shows the driving force of the transformation of the country, and also reflects that the MLCC industry is forming a new logic. In this regard, local MLCC enterprises also know well, and have made a lot of development achievements in recent years.

The big market provides space for local companies

For domestic MLCC enterprises, the head manufacturers to the high-end field migration, empty the basic product field of course to grasp in hand. However, in the current downturn in the consumer market, domestic enterprises should work with the head manufacturers to welcome the new industrial logic, and constantly consolidate and improve the high-end market share, one can avoid the uncertainty of their own development, two can form a stronger support for the domestic automobile and other high-end industrial chain, and help improve the local self-sufficiency rate of components.

At present, domestic MLCC enterprises have made a breakthrough in high-end products, for example, Shenzhen Yuyang, Micro Technology have been able to produce 008004 size ultra-small devices. In the car market, Fenghua high-tech as one of the first domestic shipping companies, its cooperation with car companies is promoting, and strive to this year car product sales accounted for 10%. In the downturn of consumer electronics, Micro Rong Technology raised 2 billion yuan last year, aiming at high capacity and vehicle regulation materials, its first phase of the B plant has been successfully put into production in the first quarter of this year. Yuyang Technology is also expanding MLCC production in Dongguan, among which 5 advanced production lines are all for vehicle standard level products. In addition, it also plans to expand more production in the new East China base.

According to statistics, the consumption of vehicle MLCC in China will increase from nearly 150 billion in 2021 to more than 280 billion in 2025. For these new demand, the greater the supply proportion of domestic manufacturers, the stronger the security of China's industry. Compared with foreign enterprises, local enterprises are more "down to earth" in customer service, technical support and quotation, and their operating costs have the potential to be continuously optimized. At present, there are both new opportunities for the automobile industry and the strategic pattern of self-sufficiency in components, which is undoubtedly a rare development opportunity for local MLCC manufacturers.

Learn more about our links! (*^▽^*)

→ ~~diary ^_^ 20230526

→ ~~diary ^_^ 20230526

| |

|

| |

|

| |

|